These days, real estate goes beyond just buildings and land. A new kind of real estate called digital real estate has appeared. Digital real estate investment is making it easier and more affordable for people like you to own property and earn income, with concept slike real estate tokenization.

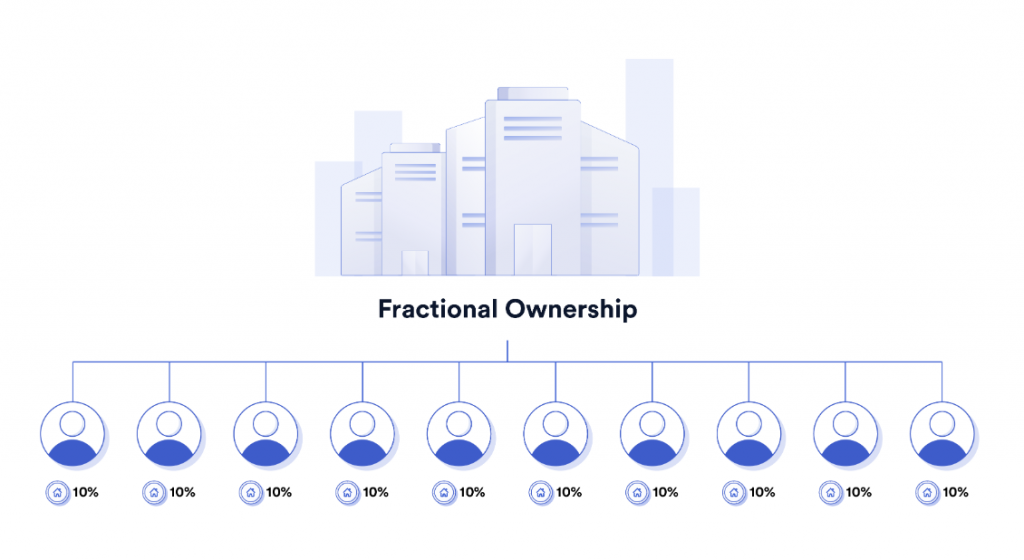

Real estate tokenization breaks down the property into digital tokens, which you can buy to own a small part of a property.

Why does this matter?

Well you don’t need a huge amount of money to start. You can invest a few hundred dollars instead of needing to buy an entire building. As you own tokens, you earn a share of the property’s income, just like owning stock in a company that pays dividends.

In 2024, the global real estate tokenization market is expected to be worth USD 3.5 billion. By 2033, it’s projected to grow to USD 19.4 billion.

In this guide, you’ll learn how digital real estate works, why it’s valuable, and how you can start investing.

What is Digital Real Estate?

Digital real estate is the process of using blockchain to tokenize physical properties. Essentially, a property (like a rental building or office space) is divided into digital tokens, each representing a small share of ownership.

Here’s how it works:

- Property Selection: A property owner decides to tokenize a building.

- Token Creation: The value of the property is divided into tokens. For example, a property worth $1 million might be split into 100,000 tokens, each worth $10.

- Buy Tokens: Investors like you can buy these tokens to own a share of the property.

- Earn Income: You earn income based on your share. If the property generates rental income, you receive a portion of it based on how many tokens you own.

- Sell or Trade: When you want to exit, you can sell your tokens on a platform, making it easy to liquidate your investment.

How is Digital Real Estate Investment Beneficial?

Digital real estate investment offers many benefits that traditional real estate can’t match. Here’s why it might be the right choice for you:

1. Lower Cost of Entry

In the past, buying a property required a big upfront investment, but with real estate tokenization, you can get started for much less. You can buy tokens representing a share of a property for as little as $100, depending on the platform.

Example: Instead of needing $500,000 to buy an entire apartment, you can own a share of it for $500 through real estate tokenization.

2. Global Access to Properties

You can invest in properties around the world without being restricted by location. Tokenized real estate platforms allow you to buy a share in properties in different cities or countries.

Example: Own a piece of real estate in New York, Tokyo, or Paris without leaving your home.

3. Passive Income

Just like owning a rental property, you can earn passive income from tokenized real estate. When the property generates rental income, you get a share based on how many tokens you hold.

Example: If you own 5% of the tokens in a property that earns $5,000 in monthly rent, you’ll receive $250.

4. Liquidity and Flexibility

In traditional real estate, it can take months to sell a property. With tokenized real estate, you can sell your tokens on a platform’s marketplace quickly, offering more liquidity. If you need to access your digital real estate investment funds, you can sell your tokens within days or even hours, unlike traditional real estate, which can take months.

5. Diversification

Tokenized real estate lets you diversify your investments. You don’t have to put all your money into one property. You can buy small shares in several properties across different markets, reducing your risk.

Estate Protocol: Real Estate Investment Platform

Estate Protocol is a platform that makes real estate investment accessible to everyone by offering fractional ownership through tokenization. It allows users to invest in international properties, typically from stable economies, with minimal upfront capital.

Why Choose Estate Protocol?

1. Invest Globally

You can invest in international properties from stable economies without the hassle. Estate Protocol takes care of the research, so you don’t have to.

2. Low Investment Costs

Start with just 100 USDC, making real estate accessible without needing large sums of money upfront.

3. Security & Transparency

All transactions are secure and fully transparent through blockchain, so you always know where your money is.

4. Future Flexibility

Soon, you’ll be able to leverage your investments through decentralized finance (DeFi) options, like property-backed loans.

Digital Real Estate Investment with Estate Protocol: A Step-by-Step Guide

If you’re ready to start investing in tokenized real estate, follow these steps using Estate Protocol:

1. Sign Up for an Account

To begin investing, visit the Estate Protocol website and create an account. Here’s what you need to do:

- Register: Enter your email, create a password, and verify your account.

- Verify Identity: Complete a quick KYC (Know Your Customer) verification by providing identification documents. This ensures security and compliance.

Estate Protocol is SEC compliant, so you can trust that the platform meets strict legal standards.

2. Explore the Marketplace

Once your account is set up, explore the Marketplace, where you can browse various real estate opportunities. Estate Protocol lists fractional real estate options from stable economies around the world, such as Miami, Dubai, and other high-demand cities.

The marketplace features properties with full details, including location, rental yield, and investment terms. As of September 2024, the market value of tokenized real-world assets (RWAs) has surpassed $12 billion.

3. Select a Property

After exploring, select the property that fits your digital real estate investment goals. Estate Protocol provides properties from stable economies, backed by thorough due diligence and historical data, ensuring a reliable investment.

You can filter properties by region, rental yield, or investment amount. With Estate Protocol, you can diversify your digital real estate investments across multiple properties to reduce risk.

4. Purchase Property Tokens

Once you choose your property, you’ll need to buy tokens representing fractional ownership of the property. You’ll be entitled to rental income and a share of the property’s appreciation. Estate Protocol accepts USDC stablecoin as payment.

Enter the amount you wish to invest, confirm the payment with USDC, and receive your tokens.

5. Start Earning Rental Income

As soon as your purchase is complete, you’ll begin earning passive income through rent from the property. Estate Protocol manages the property for you, ensuring 100% transparency in rent collection and distribution.

- Rent Collection: Rent is collected and distributed monthly based on the percentage of tokens you hold.

- Annual Appreciation: In addition to rental income, your tokens also increase in value as the property appreciates over time.

Fact: Tokenized real estate on Estate Protocol generates an estimated 8-10% return annually, higher than traditional real estate investments.

6. Track Your Digital Real Estate Investments

Once you own tokens, you can monitor the performance of your digital real estate investments through Estate Protocol’s dashboard. The platform provides real-time updates on your rental income, property appreciation, and market trends.

- Investment Tracking: View your portfolio, rental payments, and property value all in one place.

- Market Insights: Estate Protocol’s AI-driven insights provide you with updates on property markets, helping you make informed decisions.

7. Sell Your Tokens Anytime

If you decide to liquidate your digital real estate investment in Estate Protocol, properties can be sold 24/7 with global accessibility, offering liquidity and flexibility not found in traditional real estate markets.

List your tokens for sale on the marketplace, and other investors can buy them, giving you flexibility and fast liquidity. Unlike traditional real estate, where selling a property can take months, tokenized real estate can be sold in days or even hours.

Bottomline

Tokenized real estate is revolutionizing the way people invest in property. With lower costs, global access, passive income, and the ability to sell shares quickly, it’s a compelling option for modern investors. As with any investment, research is key—start small, and as you grow more comfortable, expand your portfolio to unlock even greater opportunities.

Start your digital real estate investment journey with Estate Protocol today.

FAQs

1: Is digital real estate investment good for beginners?

Yes, it’s an excellent option for beginners because the cost to enter is low, and you don’t need to manage a property yourself. Many platforms handle property management, making it a hassle-free investment.

2: What are the risks of digital real estate investment?

Like any investment, tokenized real estate carries some risks. Property values can fluctuate, and there are regulatory challenges. This is why you need to diversify your investments and don’t invest more than you’re willing to lose.

3: How liquid is tokenized real estate compared to traditional real estate?

Tokenized real estate is much more liquid. You can sell your tokens on a platform’s marketplace quickly, unlike traditional real estate, which can take months to sell.

4: Do I need cryptocurrency to invest in tokenized real estate?

Some platforms require cryptocurrency like Ethereum for transactions, but others accept traditional payments, such as credit cards or bank transfers.