Dubai’s real estate market has always generated considerable hype and for good reason – it’s consistently provided investors with several opportunities to grow their wealth. This post is about another such opportunity in Dubai: the Regent Court, a five-storey residential building located in the vibrant Jumeirah Village Circle (JVC).

And it’s not your average real estate listing.

JVC ranks second on Bayut’s Dubai Sales Market Report for H1 2023 list of top neighborhoods in the city. Estate Protocol is offering a unique chance to invest in a prime one-bedroom apartment on the 5th floor of this sought-after real estate in Dubai.

Here’s an in-depth look at the property, the investment potential, and why JVC remains a top choice for property investors in Dubai. We will also learn why tokenized real estate is the new way to approach real estate investment.

Real Estate in Dubai: One Bedroom Apartment in Regent Court

Here, number of tokens refers to the total number of digital tokens available for investment in the property.

Simply put, this means the property is divided into 5,581 tokens, each priced at 50 USDC. To invest, you can purchase these tokens, with each token representing a small portion of the property’s total value and share in its rental income and appreciation.

Estate Protocol allows you to own a part of one of Dubai’s hottest real estate markets for as little as 50 USDC. With strong rental potential and long-term growth prospects, this is a brilliant opportunity to tap into Dubai’s housing sector.

For Those Who Need a Refresher: What is Tokenized Real Estate?

Real estate has long stood as one of the most stable and rewarding investments. But high upfront costs, geographic limitations, and economic volatility, especially in high-inflation countries, have made it difficult for many to access these opportunities. Especially new-age investors.

Enter tokenized real estate, a revolutionary investment model that breaks down these barriers, making property ownership more accessible, flexible, and secure for investors worldwide.

Estate Protocol offers a seamless investment experience by enabling investors to purchase property shares using USDC or other stablecoins, a stable cryptocurrency pegged to the US dollar.

This digital asset approach eliminates the complexity of traditional real estate transactions, making it easier for investors worldwide to participate in the Dubai housing market.

About Regent Court Dubai

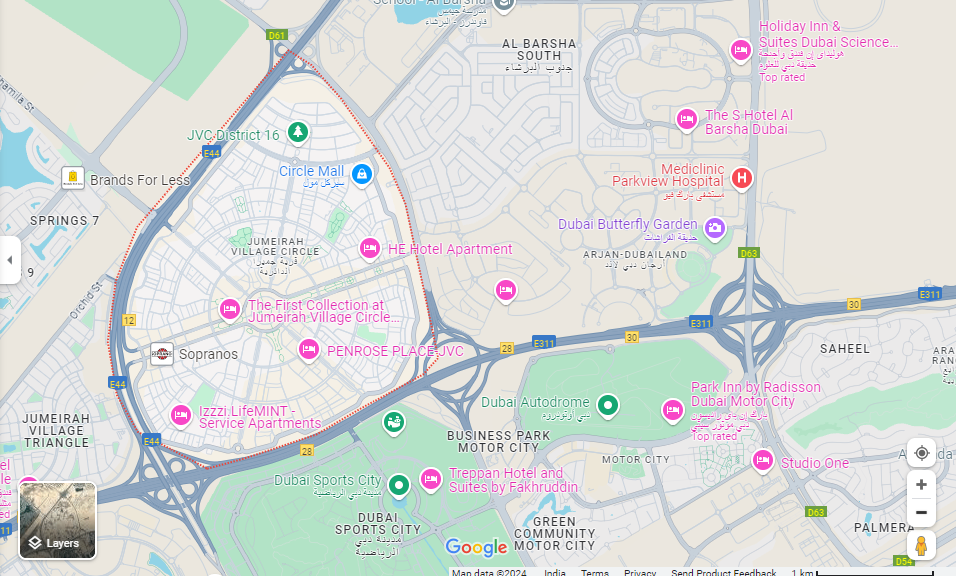

Regent Court is a five-storey residential building developed by Mr. Ahmed Muneir Mohammed Dahab and Korek Real Estate Developers, with architectural work by Modular Design Engineering Consultants. The building, completed in February 2018, is situated in JVC District 14, one of the city’s most dynamic areas.

Building Features:

- Modern apartments with stylish interiors and top-notch amenities.

- Rooftop pool, fully equipped gymnasium, sauna, ample parking, and state-of-the-art security.

- Convenient access to major highways, ferry terminals, and the metro.

Proximity to Key Destinations:

- 22 minutes to Dubai Mall.

- 17 minutes to Palm Jumeirah.

- 18 minutes to Burj Al Arab.

- 20 minutes to The Walk, JBR.

- 27 minutes to Dubai International Airport (DXB) and 36 minutes to Al Maktoum International Airport.

Located on the 5th floor of Regent Court, this 797 sq ft one-bedroom apartment offers everything tenants could want. The spacious living area, modern kitchen, and private balcony provide a comfortable living experience in one of Dubai’s most sought-after residential areas.

Potential Return in 5 Years:

Assuming current trends continue with a capital appreciation of 6% per annum, the property’s value in five years could reach approximately AED 1,372,000. Combined with rental income, investors could achieve a 44% total return* or an average of 8.75% per year, including both rental income and capital growth.

*Any forecasts or assumptions provided are considered based on market and past performance data and for illustrative purposes. Past performance is not indicative of future results. You are encouraged to use the Financial Pro-forma provided to apply your own assumptions.

Why Jumeirah Village Circle (JVC)?

Jumeirah Village Circle (JVC) has emerged as one of the most sought-after communities in Dubai, offering a blend of apartments, villas, and townhouses that cater to a wide demographic.

Nestled in the heart of New Dubai, JVC is renowned for its balance of urban living within a tranquil, village-like environment. As a hub of growing real estate interest, it’s no surprise that JVC has become a focal point for investors, residents, and developers alike.

The community is known for its lush landscaped parks, tree-lined streets, and scenic canals, creating a serene environment that appeals to families, young couples, and singles.

JVC’s proximity to major business hubs like Dubai Marina, Internet City, Media City, and Jumeirah Lake Towers (JLT) enhances its appeal for those working in the city while enjoying a suburban lifestyle.

A Thriving Real Estate Hub

According to Bayut’s H1 2023 Dubai Rental Market Report, JVC tops the list for affordable apartment rentals in Dubai, making it a prime choice for those looking to own or lease property.

JVC is home to over 2,000 residential units, ranging from apartments and villas to townhouses. Most developments in the area offer shared amenities, including gyms, swimming pools, and laundromats. The area continues to see exciting new projects, providing fresh housing options for residents looking to rent or buy in a prime location.

Why Invest in UAE Real Estate?

The UAE (United Arab Emirates) remains a top destination for real estate investments due to its strong economic fundamentals and investor-friendly policies. It also has:

- A Booming Real Estate Sector: The UAE’s real estate market is experiencing robust growth, driven by increasing demand for residential properties, high levels of foreign direct investment, and government initiatives to support the sector.

- A Stable Economy: The UAE’s economic stability, supported by a diversified economy, makes it a secure environment for real estate investments. The nation’s investor-friendly policies, including long-term visas for property investors, make it an attractive destination.

How to Get Started on Estate Protocol

Investing in this property is simple and straightforward:

- Sign Up: Create your account on the Estate Protocol platform.

- Purchase Tokens: With a minimum investment of just 50 USDC, you can own a part of this prime property.

- Earn Returns: Start earning rental income once the lease begins in December 2024.

Fractional Ownership on Estate Protocol: Why Should Investors Care?

As stated, until recently, investing in real estate required significant capital outlay—a barrier for many. Estate Protocol allows you to invest in tokenized real estate which not only lowers the entry barriers but brings a host of benefits:

- Wealth Preservation in Stable Assets: On Estate Protocol, investors can convert their local currency into stablecoins like USDC to purchase property tokens, protecting their wealth from the devaluation caused by inflation.

- Global Access to High-Performing Markets: Investors may not have access to lucrative real estate markets in their own countries. Estate Protocol allows them to invest in booming international markets like the Dubai housing market.

- Liquidity and Flexibility: Traditional real estate investments are often illiquid, meaning it can take months or even years to sell a property and access the capital. On Estate Protocol, investors can easily buy or sell tokens on secondary markets, offering greater liquidity and the flexibility to adjust investments as needed.

- Passive Income Opportunities: Many tokenized properties, such as long-term rental apartments, generate regular income in the form of rental yields. For example, investors in tokenized real estate at Regent Court, Jumeirah Village Circle (JVC), Dubai can expect annual returns from rental income, allowing them to generate passive income while protecting their wealth in a stable asset.

- Transparent and Secure Transactions: Powered by blockchain technology, tokenized real estate ensures transparent ownership and secure transactions. Blockchain records every transaction on a decentralized ledger, making it nearly impossible to tamper with or alter ownership records.

The Future of Real Estate Investment

The one-bedroom apartment at Regent Court, JVC, is more than just a real estate investment—it’s a smart financial move in one of Dubai’s most promising communities. With affordable entry via USDC tokens, high rental demand, and strong capital appreciation prospects, this investment offers a balanced approach to portfolio growth.

Don’t miss your chance to be part of Dubai’s thriving real estate market—invest in Regent Court today through Estate Protocol!

Estate Protocol: A Fractional Real Estate Investment Platform

The value of your money is directly impacted by inflation, and to protect against it, many people turn to stablecoins. However, holding idle stablecoins doesn’t help your wealth grow.

Enter Estate Protocol—a platform that lets you invest in fractional ownership of real estate in stable economies worldwide, using stablecoins. This way, your stablecoins become productive assets, helping you grow your portfolio.

- Fractional investment: Investors can purchase a portion of a property rather than the entire asset.

- Global investment: Offers properties in various countries, allowing for diversification.

- Rent generation: Investors can earn rental income from their property shares.

- Blockchain technology: Utilizes blockchain to tokenize real estate and ensure transparency.

- Curated properties: Provides a selection of properties after due diligence.

- Low investment threshold: Investors can start with as little as $50.

Follow Estate Protocol on X and read our blogs to stay updated about the real estate market. Start your journey of owning tokenized real estates today.