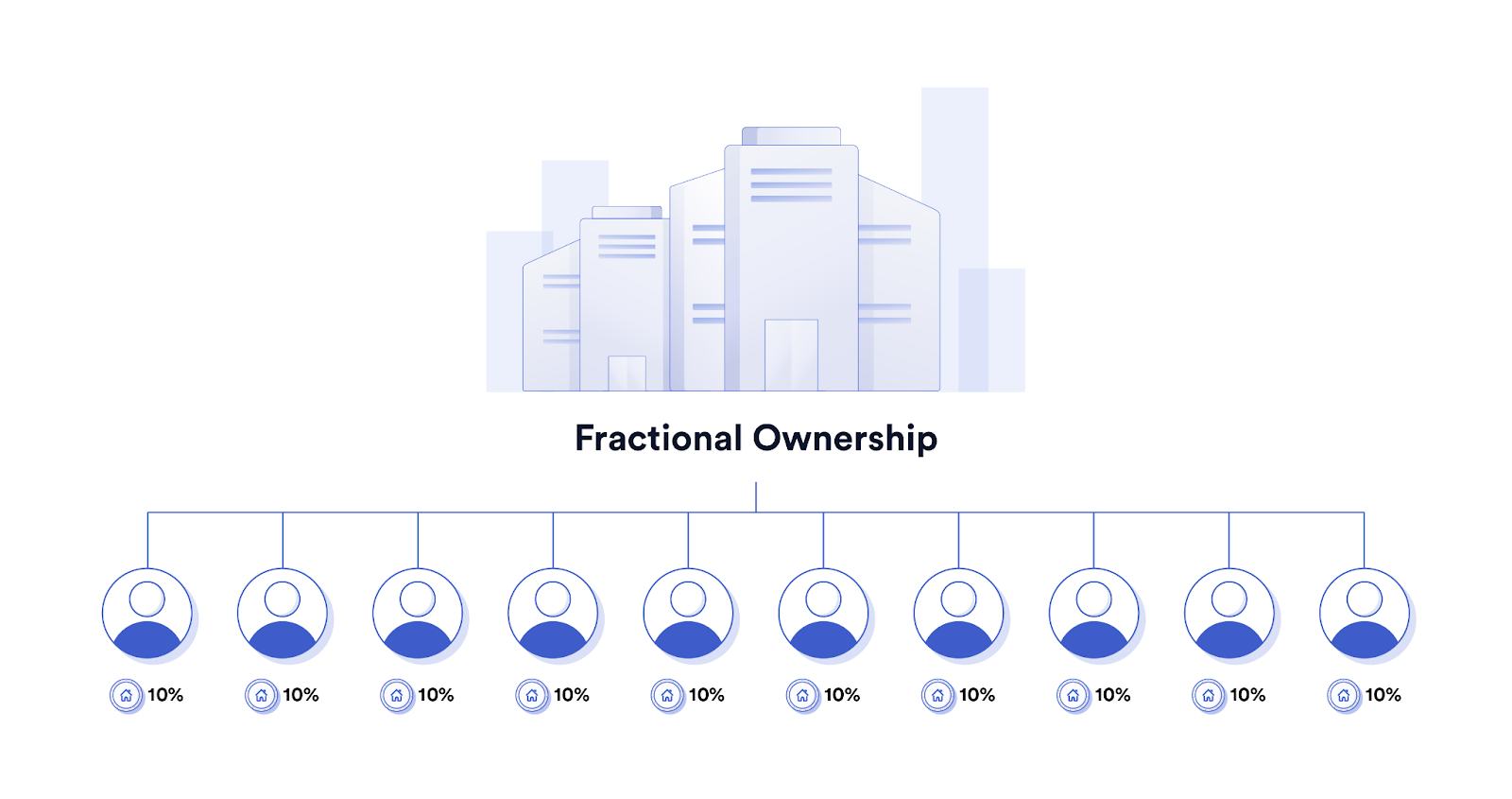

For those who don’t have the capital for full ownership of real estate – fractional ownership is on its way to being a mainstream solution. Real estate investment trusts (REITs) and limited partnerships allow investors to pool resources to buy property. But fractional ownership has its drawbacks: limited liquidity, lack of transparency. Invest in Tokenized real estate and solves these woes.

In real estate tokenization, physical assets are represented as digital tokens on a blockchain- which brings its benefits. Now, you can own fractional shares of luxury properties in prime locations by investing as low as $50, thanks to platforms like Estate Protocol.

But that’s just the beginning. There are many other advantages of real estate tokenization. Let’s explore how it compares to traditional real estate investment models and why we believe it is the future of real estate investment.

What is Tokenization of Real Estate? How Does It Work?

Tokenization of real estate is transforming how we invest in property. Traditional real estate investment is slow and complicated, with buying or selling taking weeks or months. Prices can fluctuate and deals involve many middlemen.

As stated, real estate tokenization is a solution to many of these issues. By converting physical properties into digital tokens on a blockchain- buying, renting, and selling real estate becomes more streamlined.

Instead of owning an entire building or home, investors can purchase “tokens” representing a fraction of the property. These digital tokens are recorded on the blockchain, ensuring transparency and security through a tamper-proof ledger.

With tokenization, investors can trade fractions of properties quickly, quite similar to how stocks or other liquid assets are traded.

As there are no middlemen involved, the process is faster and smoother.

It was Ethereum in 2015 that brought smart contracts – self-executing agreements stored on the blockchain, into mainstream use. This development made it possible to tokenize physical assets like real estate, art and commodities.

How does Tokenized Real Estate Stack up Against REIts and Traditional Real Estate Investment?

Tokenized real estate, REITs (Real Estate Investment Trusts), and traditional real estate investment are different ways of investing in real estate. Let’s see how they stack up against each other:

Liquidity

- Tokenized Real Estate: Real estate tokens can be traded on various platforms. The presence of a secondary market makes it easier to invest in tokenized real estate or exit such investments and provides liquidity.

- REITs: These are publicly traded on stock exchanges. As such, they provide better liquidity than owning physical properties.

- Traditional Real Estate: This is the least liquid of the three. Buying and selling properties takes time and comes with high transaction costs.

Ownership and Control

- Tokenized Real Estate: When you invest in tokenized real estate, you own fractional shares of a property. This setup not only gives you a clearer view of your investments but also offers greater transparency regarding individual assets. Plus, blockchain technology provides secure, real-time updates on how those assets are performing.

- REITs: With Real Estate Investment Trusts, you’re buying shares in a company that owns real estate and as such you won’t have direct control over individual properties. The management team makes all the decisions, which means you might not have full visibility into what’s happening at the property level.

- Traditional Real Estate: Here, you have complete control over your property, but managing it isn’t always easy. It often requires a huge investment of time, effort, and expertise to keep things running smoothly.

Diversification

- Tokenized Real Estate: This method allows for diversification. You can invest in multiple tokenized real estate with small amounts of capital.

- REITs: They also offer diversification but through professionally managed portfolios. However, achieving a well-rounded mix of properties still requires a considerable investment upfront.

- Traditional Real Estate: Diversifying here can be tough. High capital requirements often mean investors focus on just a few properties in specific areas, which can limit their ability to manage risk effectively.

Regulatory and Tax Considerations

- Tokenized Real Estate: While this space is still figuring out the regulatory landscape, there’s potential for some tax benefits. Keep in mind, though, that the rules can vary widely depending on your location.

- REITs: On the flip side, REITs benefit from well-established regulations, making them a safer bet. They enjoy tax advantages.

- Traditional Real Estate: Investing directly in properties comes with its own set of complex tax and legal responsibilities, including dealing with property taxes, maintenance, and various obligations.

Why You Should Invest in Tokenized Real Estate? Benefits of Investing in Tokenized Property

Investing in tokenized property offers several key benefits, making it an attractive option for both small-scale and large-scale investors:

1. Better Price Discovery

Since tokenized real estate is traded on blockchain-based platforms, market prices are more transparent. Investors can see real-time data on supply and demand, improving the accuracy of property valuations.

2. Lower Costs

Blockchain reduces the need for intermediaries like brokers, reducing transaction costs. Smart contracts automate processes, eliminating paperwork and legal fees that traditional real estate deals incur.

3. Increased Liquidity

Traditional real estate is often illiquid, but tokenized assets allow investors to buy and sell fractions of properties. This makes it easier to enter or exit investments, creating more liquidity in the market.

4. Less Prone to Fraud

Through blockchain technology, every transaction is recorded in an immutable ledger.This transparency reduces the likelihood of fraudulent activity, providing peace of mind for investors.

5. Opportunities for Small-Scale Investors

Previously, investing in high-value properties required significant capital. Tokenization allows smaller investors to buy fractional shares of luxury properties, democratizing access to high-end real estate markets.

6. More Transparency

Every transaction, ownership detail, and investment history is stored on the blockchain, creating a clear and transparent record for all parties involved. This level of transparency builds trust among investors.

7. Free-Flowing Market

Unlike traditional real estate markets that operate within specific hours, tokenized real estate allows for 24/7 trading, providing greater flexibility for investors.

The Bottomline on Real Estate Tokenization

The total value of tokenized assets is expected to touch $10 trillion by 2030. Tokenization of real estate is attracting both retail and institutional investors, including asset managers and pension funds, who are incorporating tokenized property into their portfolios. The integration of tokenized assets with decentralized finance (DeFi) offers more flexibility, like using tokens as collateral for loans.

Investing in tokenized real estate can be worthy, especially for those seeking diversification and lower entry barriers into the property market.

However, regulatory and security challenges remain, so investors should research the legal landscape before diving in. The sector is expected to grow as regulations become clearer and the technology matures.

Estate Protocol: A Fractional Real Estate Investment Platform

Estate Protocol is a blockchain-based platform that facilitates the tokenization of real estate assets. It enables property owners to convert their assets into digital tokens, making it easier to buy, sell, and trade fractions of real estate.

The mission of Estate Protocol is to increase liquidity, enhance transparency, and provide access to the real estate market to a broader range of investors.

By leveraging smart contracts, Estate Protocol automates processes like rental income distribution and property management, streamlining operations for both investors and property owners.

Follow Estate Protocol on X and read our blogs to stay updated about the tokenized real estate market.